Lets say as a technical analyst, Each day We will go to the browser and check on the trading chart with so much line and color. As a ta trader, You will provide intense time on researching chart and maybe you will have your own favorite chart pattern (fibo, elliot, bollinger etc.). So frankly speaking, I respect those trader whose trade is backed by fact. But personally, I m very bad at technical analysis and drawing chart. But love the topic price action. So back in 2021, I have developed a strategy summary feature.

So basically what is strategy summary.

So We have rule based system where we create trading rule such as if rsi >30 (buy) and rsi < 70 (sell). Not new feature it is also provide on chukul. So it was fun to learn about different strategy. I never knew there was like chandelier exit trading strategy. So it was over like 100+ strategy who will provide me visually about history back testing data.

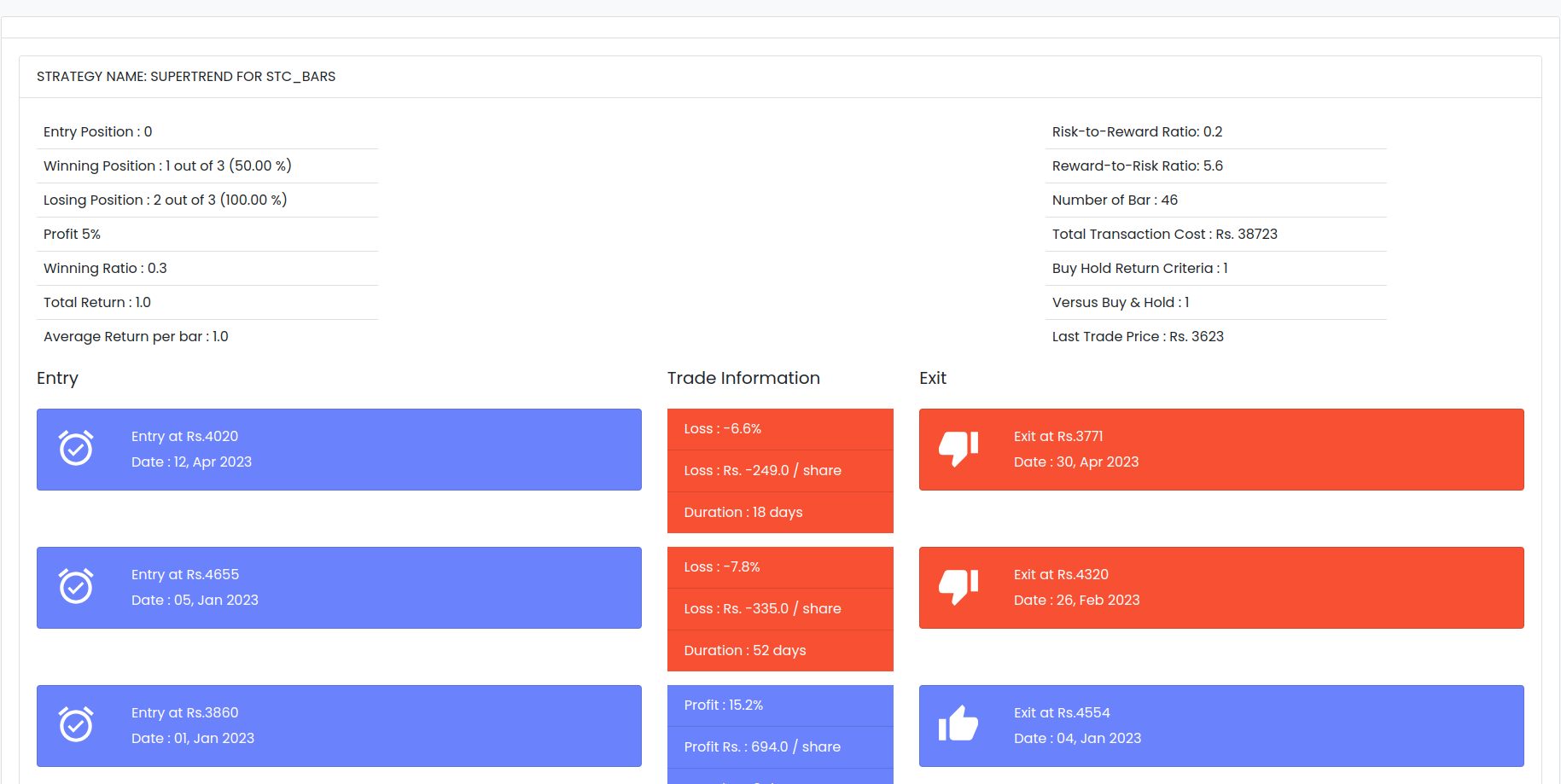

Below is the example of stock STC. (please mind the date, I m currently doing some clean up during this weekend.)

so as u can see we have winning position, losing position, overall pl. So I m big fan of sikincha.com. I have learn so much from him. He is also big fan of super trend. So above image is from supertrend strategy. before i discover sikincha.com youtube video, I was very much confused with alot of strategy generating a lot of buy signal from different stock. Which make it very hard to trade and too much option always kill the trader. So I have only kept supertrend strategy. It is kinda generating ok data I guess thats why i came here to vent it out. It always confusing that can we create what TA do in chart in a software. Pretty much from my 2 year experience on developing these project. I m now incline to may be not 100% possible. You can share your views. it will really help me understand thing.

So lately When I think about my trading, when mr market nepse was just my local setup. I will have to go to the https://mrmarket.avocado.com.np/ and prepare list of the criteria which need to be meet before buying or selling stock.

simple criteria list

So i think i have been able to catch 50% of good trade from here. and another 50% bad trade i get it from fomo, impatient.

So guy if you have good knowledge of backtesting, you can share your knowledge. it will be great help.