Hello traders, today i will like to talk about Donchian Channel Strategy. Explain the result found during backtesting its data with ngpl.

The Donchian Channel is a tool used in financial markets to show the highest and lowest prices of an asset over a certain period of time. It's typically displayed on charts that use candlesticks to represent price movements. Candlesticks show the opening, highest, lowest, and closing prices of a stock within a specific time frame. So, the Donchian Channel essentially draws lines connecting the highest and lowest points of these candlesticks over a set period.

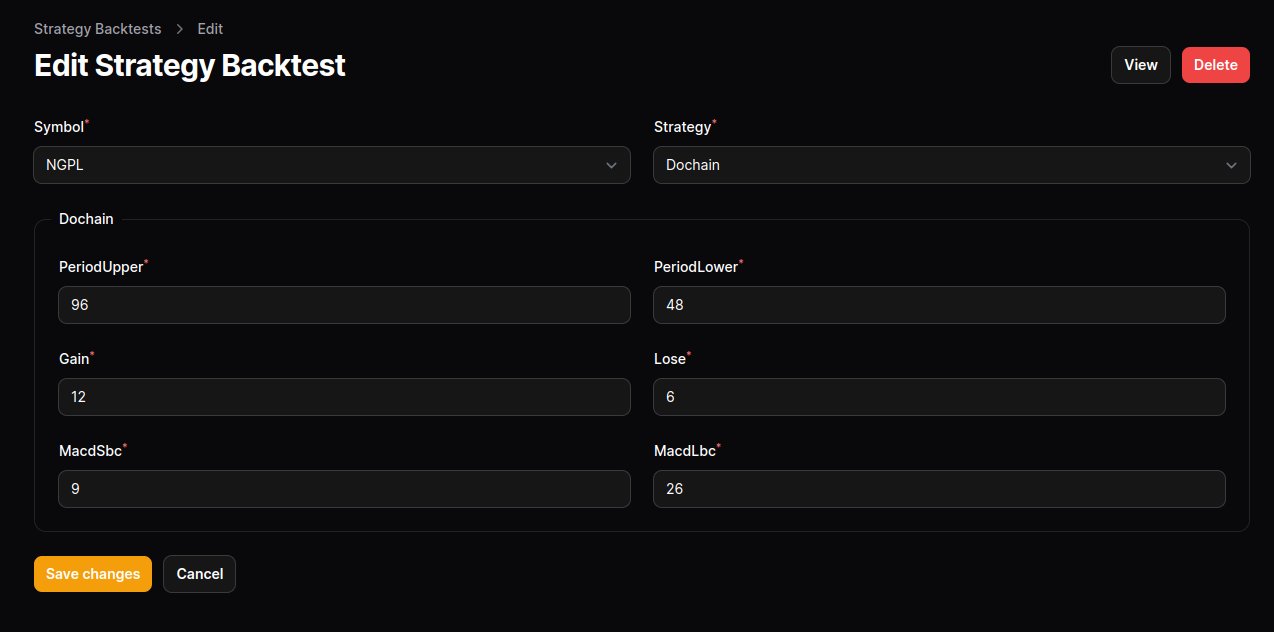

Strategy parameter

Upper Channel = 96 days

Lower channel = 48

Macd short bar = 9

Macd long bar = 26

Stop gain : 12 %

Stop loss : 6%

Setup

Buy Signal Generation: The strategy generates a buy signal when two conditions are met simultaneously:

The price breaks above the upper Donchian Channel band (indicating potential upward momentum).

The MACD (Moving Average Convergence Divergence) indicator crosses above zero (indicating potential bullish momentum).

Sell Signal Generation: The strategy generates a sell signal when any of the following conditions are met:

The price falls below the lower Donchian Channel band (indicating potential downward momentum).

The price hits a stop gain or stop loss threshold.

Additionally, it checks if the trade falls within a specified time range.

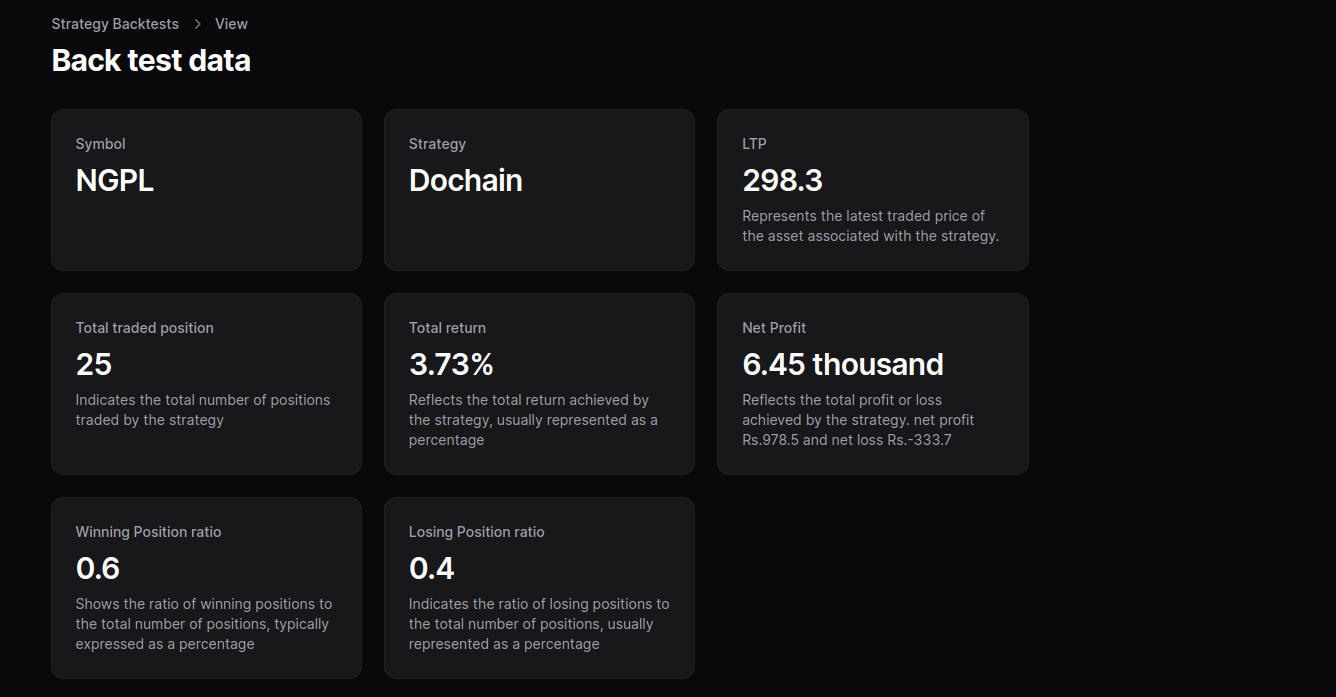

When I run the back test with other stock it was showing ok return, When I run it with ngpl. we can see that winning ratio:losing ratio is 0.6:0.4.

When I study the list of position of last 7 trades. It give average 3.5% profit. Taking all trade in account, we can see that it has give you 2.73% as return.

I have also backtested other script but is not able to get better result than this.

You can also test your stock here https://trader.avocado.com.np/admin/strategy-backtests